Worldwide Spending on Security Solutions Forecast to Reach $91 Billion this Year

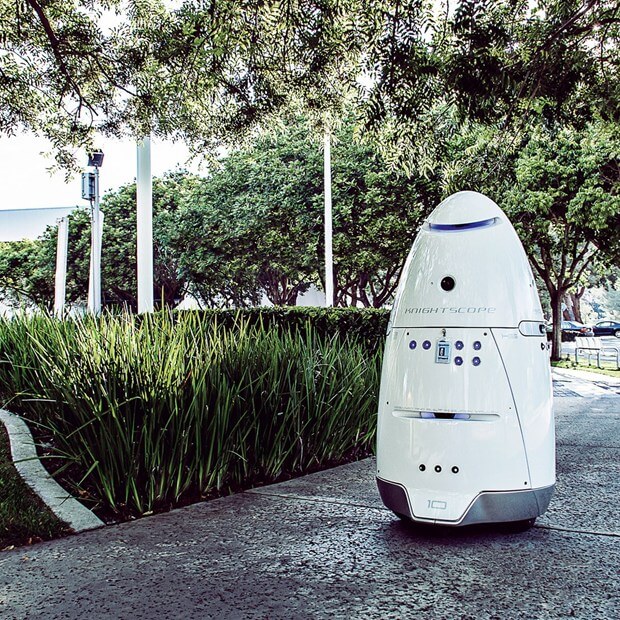

Knightscope security robot. Last year, Konica Minolta announced that it has invested in and partnered with the maker of the security robot, Knightscope.

Worldwide spending on security-related hardware, software, and services is forecast to reach $91.4 billion in 2018, an increase of 10.2 percent over the amount spent in 2017. This pace of growth is expected to continue for the next several years as industries invest heavily in security solutions to meet a wide range of threats and requirements. According market-research firm International Data Corporation’s Worldwide Semiannual Security Spending Guide, worldwide spending on security solutions will achieve a compound annual growth rate (CAGR) of 10.0 percent over the 2016-2021 forecast period and total $120.7 billion in 2021.

Eileen Smith, program director of Customer Insights and Analysis for International Data Corporation (IDC), commented: “Banks, discrete manufacturers, especially within the high-tech sector, and the federal government are spending the most on security to avoid large-scale cyber-attacks and adhere to regulatory compliance. Looking ahead to 2021, as the need the to protect IoT (Internet of Things)-connected devices and infrastructure becomes paramount, industries like telecom and state and local government will drive growth in worldwide security spending.”

According to IDC, the three industries that will spend the most on security solutions in 2018 – banking, discrete manufacturing, and federal/central government – will deliver more than $27 billion in spending combined.

Four other industries (process manufacturing, professional services, consumer, and telecommunications) will each see spending greater than $5.0 billion this year. The industries that will experience the fastest spending growth over the 2016-2021 forecast period will be telecommunications (13.1 percent CAGR) education and state/local government (each with an 11.6 percent CAGR), banking (11.4 percent CAGR), and the resource industries (11.3 percent CAGR).

Managed security services, which are single-tenant solutions operated by third-party providers and residing on the customers’ premises, will be the largest technology category in 2018, with firms spending nearly $18 billion for these services, according to IDC.

Managed security services will also be the largest category of spending for each of the top five industries this year. The second-largest technology category in 2018 will be network-security hardware, followed by integration services and endpoint security software.

The technology categories that will see the fastest spending growth over the forecast will be managed security services (14.7 percent CAGR), network security hardware (11.3 percent CAGR), security and vulnerability management software (10.9 percent CAGR), and network security software (10.7 percent CAGR).

The largest geographic market for security solutions will be the United States, with total spending of nearly $38 billion this year.

The second largest geographic market will be the United Kingdom at $6.5 billion, followed by China ($6.0 billion), Japan ($5.1 billion), and Germany ($4.6 billion).

The leading industries for security spending in the United States will be discrete manufacturing and the federal/central government.

In the United Kingom, banking and discrete manufacturing will deliver the largest security spending, according to IDC, while telecommunications and banking will be the leading industries in China. China and Malaysia will see the strongest spending growth with five-year CAGRs of 26.3 percent and 19.7 percent, respectively, followed by India (18.1 percent) and Singapore (17.2 percent).

From a company-size perspective, large and very large businesses (those with more than 500 employees) will be responsible for nearly two-thirds of all security-related spending in 2018. Large (500-999 employees) and mid-size businesses (100-499 employees) will see the strongest spending growth over the forecast, with CAGRs of 11.8 percent and 11.0 percent respectively. However, very large businesses (more than 1,000 employees) will grow nearly as fast with a five-year CAGR of 10.1 percent. Small businesses (10-99 employees) will also experience solid growth (9.9 percent CAGR), with spending expected to reach $8.3 billion in 2018.

“IDC predicts that by 2020, 30 percent of security spending will be on vendors that provide an integrated platform approach to security,” said Sean Pike, program vice president for IDC’s Security Products and Legal, Risk, and Compliance programs. “This shift will happen partly because of budget, but mostly because of complexity. Reducing complexity by moving to integrated platforms, whether in the cloud or on-premises, supporting a hybrid environment, also provides the potential for enhanced security as companies will make gains in manageability and automation.”

IDC’s Worldwide Semiannual Security Spending Guide quantifies the global revenue opportunity for both core and next-generation security purchases. The guide offers detailed forecast data for security spending by 20 industries across nine regions and 53 countries. Unlike any other research in the industry, the comprehensive spending guide was designed to help IT decision makers to clearly understand the industry-specific scope and direction of security-related spending today and over the next five years.

For more information on the guide, contact IDC’s Michael Shirer at press@idc.com

More Resources

- March 2018: Xerox Expands Partnership with Cisco to Boost Printer and Copier/MFP Security

- February 2018: Konica Minolta Strengthens IT Security Services through Acquisition of Assets of VioPoint

- January 2018: Customers Increasingly Look for Printer Security – Not Speeds and Feeds

- January 2018: Kyocera First MFP/Printer Provider to Receive ISMS Cloud Security Certification

- January 2018: Cybercriminals Using Fake Printer/Scanners Emails with Malicious Attachments to Hack Users

- February 2018: Canon Beefs-Up Security with New Vera, Agile Partnerships for Document and Data Security

- December 2017: Xerox AltaLink Copier/MFPs First to Receive Common Criteria Certification for Security

- November 2017: Xerox, HP, Lexmark, Ricoh Named Leaders in Security Solutions

- November 2017: Sharp First Manufacturer To Achieve New International Security Standard for Copier/MFPs

- September 2017: New Quocirca Report Details Printer and Copier/MFP Security Risks

- August 2017: Kyocera Releases SecureAudit for Copier/MFP Security

- August 2017: Konica Minolta Beefs Up Copier/MFP Security with bizhub SECURE Platinum

- June 2017: Konica Minolta Announces Service Partnership with Knightscope, Maker of Security Robots

- June 2017: HP Expanding Dealer Security-Adviser Program; Expects 600 Dealers Worldwide

- January 2017: HP: Battle Hackers with these Printer Security Solutions

You must be logged in to post a comment.