This Week in Imaging: Fujifilm Envisions the New Combined Xerox-Fuji Xerox

Photo Credit: Kathleen Wirth

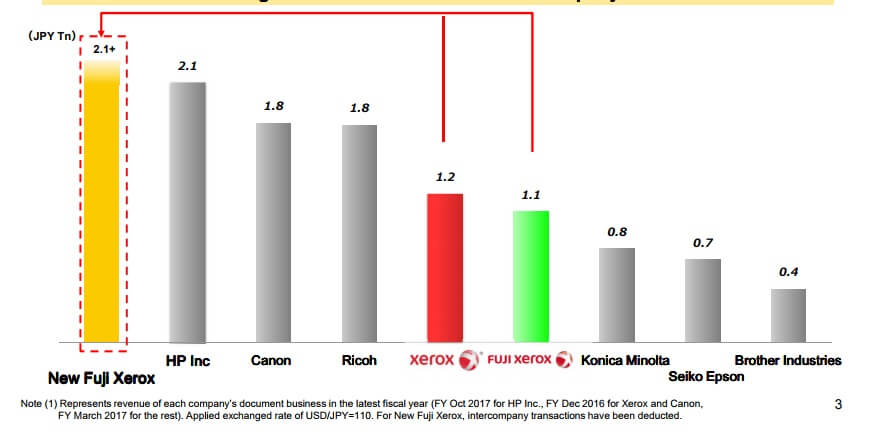

While this week, news involving two activist Xerox investors seeking to block a proposed Xerox-Fuji Xerox merger took up quite a bit of air time, we thought we’d look at how Fujiflm, which would have a controlling share in the new combined Xerox-Fuji Xerox, envisions just how the new company will take shape, and how it envisions the two companies’ strengths and advantages would propel the new company to be the world’s largest document-imaging company.

First, the new company would have dual headquarters, one in Norwalk, Connecticut, where Xerox is headquartered, and the other in Minato, Tokyo, Japan, where Fuji Xerox is headquartered. The new company would be named “Fuji Xerox,” and would remain listed on the New York Stock Exchange.

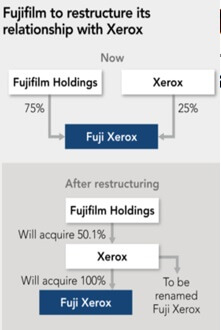

Overview of the Transaction

Fuji Xerox will buy back its 75 percent stake in Fuji Xerox from Fujifilm. Fujifilm will then use the proceeds from selling its 75 percent stake in Fuji Xerox to acquire 50.1 percent of Xerox shares. There will be no cash outflow from Fujifilm. The new Fuji Xerox, which will become a consolidated subsidiary of Fujifilm, will remain listed with the New York Stock Exchange as XRX.

Leadership of New Company

Current Xerox CEO Jeff Jacobson would be CEO of the new Fuji Xerox. According to Fujifilm, the company would be governed by a board of directors, the majority – seven out of 12 – of which would be appointed by Fujifilm. The remaining five directors would be appointed by the Xerox board. Fujifilm CEO Shigetaka Komori would be chairman of the board; he would continue to serve as chairman and CEO of Fujifilm.

A Conflicts Committee, made up of independent directors, would be set up to “protect minority shareholders,” according to Fujifilm.

The new company is expected to generate 3.3 trillion yen in annual revenue, and annual operating income of 235.0 billion yen – both of which Fujifilm says are simply the annual revenues and operating incomes of both companies added together.

The merger must first obtain the approval of Xerox shareholders and then approval by regulatory authorities. Fujifilm expects the deal to close in the July to September 2018 time period.

The new company would not only continue to focus on office document-imaging technology, but would also “expand into new markets such as industrial printing.” The ultimate goal is to be a “document solution company with one of the largest revenue scale in the world.”

The new company will leverage Fujifim’s image-processing technologies and new Xerox artificial intelligence (AI) technology to develop business-process automation solutions. It will also leverage Fujifilm’s technologies in photography, inkjet printing, photo-lithography, etc., to expand into new markets.

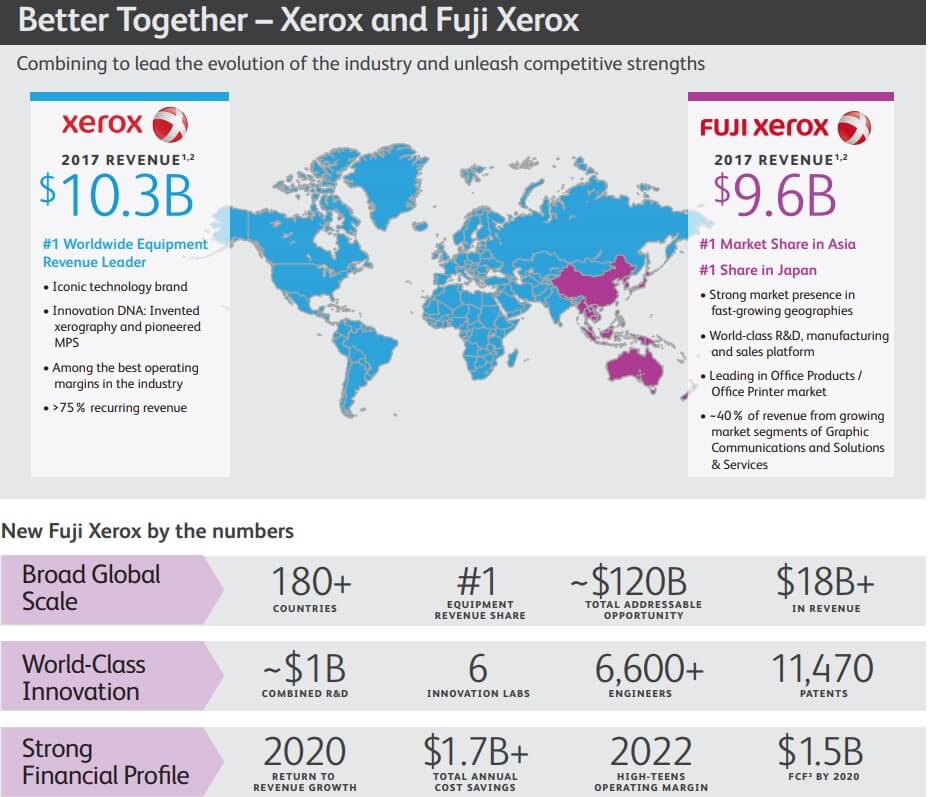

One bonus for the Xerox portion of the new company would be access to Fuji Xerox’s sales territory in Asia-Pacific.

Fujifilm notes that while in the office-imaging market in developed economies (primarily the United States, Europe, and Canada), office printing is declining, in emerging economies, such as those located in Asia-Pacific, there is “sufficient room for growth.” One of Xerox’s strengths is its leadership in Managed Print Services (MPS), which it could bring to the Asia-Pacific region.

Combining Xerox and Fuji-Xerox Strengths

The new company would benefit from a combination of both company’s strengths. Fuji Xerox’s strengths include its 56-year history of developing equipment for both Xerox and Fuji Xerox as a joint venture between Fujifilm and Xerox. Other Fuji Xerox strengths include its strong customer base in Asia-Pacific, including Japan, and its strong market share in Asia-Pacific via its direct-sales model.

Xerox’s strengths include a leading position in production printing and global services; strong brand power and recognition in the print market; and strong customer base in North America.

The new company would combine Fuji Xerox’s strong R&D, production, and sales with Xerox’s advantages in the solutions and services market.

Expected Cost Savings

By combining Xerox and Fuji Xerox, Fujifilm expects to achieve cost savings of $1.7 billion per year by 2022, and $1.2 billion per year in savings by 2020. Within the Fuji Xerox portion of the new company, Fujifilm expects to achieve cost savings of $0.45 billion per year.

Benefits for both Xerox and Fuji Xerox will be a globally unified marketing strategy, and expansion into new markets using Fujifilm’s HD technology in photography, inkjet printing, and photollithography. Meanwhile, both companies’ functional overlaps in production will be eliminated, and production, R&D, and procurement will be streamlined for cost savings.

In a meeting with press, Fujifilm’s Komori explained that, at this time, Fujifilm will not seek to own more than 50.1 percent of Xerox shares, with Komori explaining that such a move would require hundreds of billions of yen in investment, which would affect Fujifilm’s future prospects for growth.

More Resources

- February 2018: Xerox Responds to Deason Lawsuit that Seeks to Block Merger

- February 2018: Deason Files Lawsuit to Block Fujifilm Takeover of Xerox; Xerox Responds to Criticism

- February 2018: Icahn, Deason Slam Proposed Fujifilm Takeover of Xerox

- February 2018: Combined Xerox and Fuji Xerox Will Create One of World’s Largest Copier Companies, Says Fujifilm CEO

- January 2018: Xerox and Fujifilm Announce Agreement for Xerox to Merge with Fuji Xerox

- January 2018: Xerox Reports Strong Fourth-Quarter 2017 Results, 65 Dealers Signed

- January 2018: Icahn, Deason Call for Xerox CEO, Directors Replacement, Renegotiation of Fuji Xerox Partnership

- January 2018: Deason, Shareholders, Demand Xerox Disclose Potential ‘Value-Destroying’ Fujifilm Deal

- January 2018: Under Pressure from Icahn and Seeking New Growth, Xerox May be Negotiating Deal with Fujifilm

- December 2017: Billionaire Investor Icahn Blasts Xerox Board, Says Xerox ‘Desperately Needs New Leadership’

- December 2017: Carl Icahn to Nominate Four Directors to Xerox Board

You must be logged in to post a comment.