Technavio Names Top-Five Players in Production-Printer Market

London-based Technavio has announced the top five leading vendors in its recent global production printer market report covering the market up to 2021. The research report also lists six other prominent vendors its expects to affect the market during its forecast period.

Technavio explains that production printers are used for volume printing, with print speed of more than 60 ppm. Production printers are used for commercial-printing purposes such as printing books, manuals, marketing collaterals, packaging materials, and transactional documents. It expects the global production-printer market to witness an increase in the demand for production printers from various application segments such as packaging and publishing during the forecast period.

According to the firm, the global production printer market is consolidated with a few players dominating the market space. Technavio has identified the following key vendors based on their product portfolio, geographical presence, marketing and distribution channels, revenue generation, and significant investments in R&D. The top five vendors make up around 97.83 percent of the market share in terms of unit shipment.

Raghu Raj Singh, an industry expert at Technavio for research on embedded systems, commented: “Vendors consider joint ventures, partnerships, collaborations, and contracts as the preferred strategies to gain a better market share. Vendors with same goals have collaborated to form joint venture programs, to assist each other in achieving those goals. This helps them gain access to the technologies and services of their partner, which can facilitate them to achieve their objectives faster. For instance, in January 2017, Ricoh acquired Avanti Computer Systems. The acquisition was made to enhance the product portfolio of Ricoh in the global production printer market.”

The top-five production-printer market vendors according to Technavio are:

Canon

Canon is involved in the manufacture of optical and imaging products such as cameras, camcorders, steppers, computer printers, and medical equipment. The firm operates in three business segments, which are covered by its office-business unit, imaging-systems business unit, industry, and other business unit. The firm is mainly focusing on R&D to expand its product portfolio. For example, the firm is conducting the in-house development and production of ultra-high-resolution sensors.

HP Inc. and HP Enterprise

HP Inc. markets PCs, imaging- and printing-related products, while HP Enterprise markets networking products, enterprise IT infrastructures that include enterprise servers and the storage technology, and multi-vendor customer services.

Konica Minolta

Konica Minolta develops and manufactures healthcare equipment, graphics-art printers, production printers, office printers and MFPs, textile printers, and inkjet print heads. The business domain of the company consists of three segments: business technologies, healthcare, and industrial. Konica Minolta’s product and service portfolio includes business solutions, production printers, industrial inkjet printers, healthcare solutions, and measuring instruments.

Ricoh

Ricoh operates in three segments: imaging and solutions, industrial products, and others.

Xerox

Xerox sells document management solutions worldwide. The company operates in three business segments: managed document services, workplace solutions, and graphic communications. The managed document-services segment helps customers optimize their business processes, document workflow, and printing process. Xerox mainly serves the banking, education, healthcare, government, manufacturing, and retail sectors.

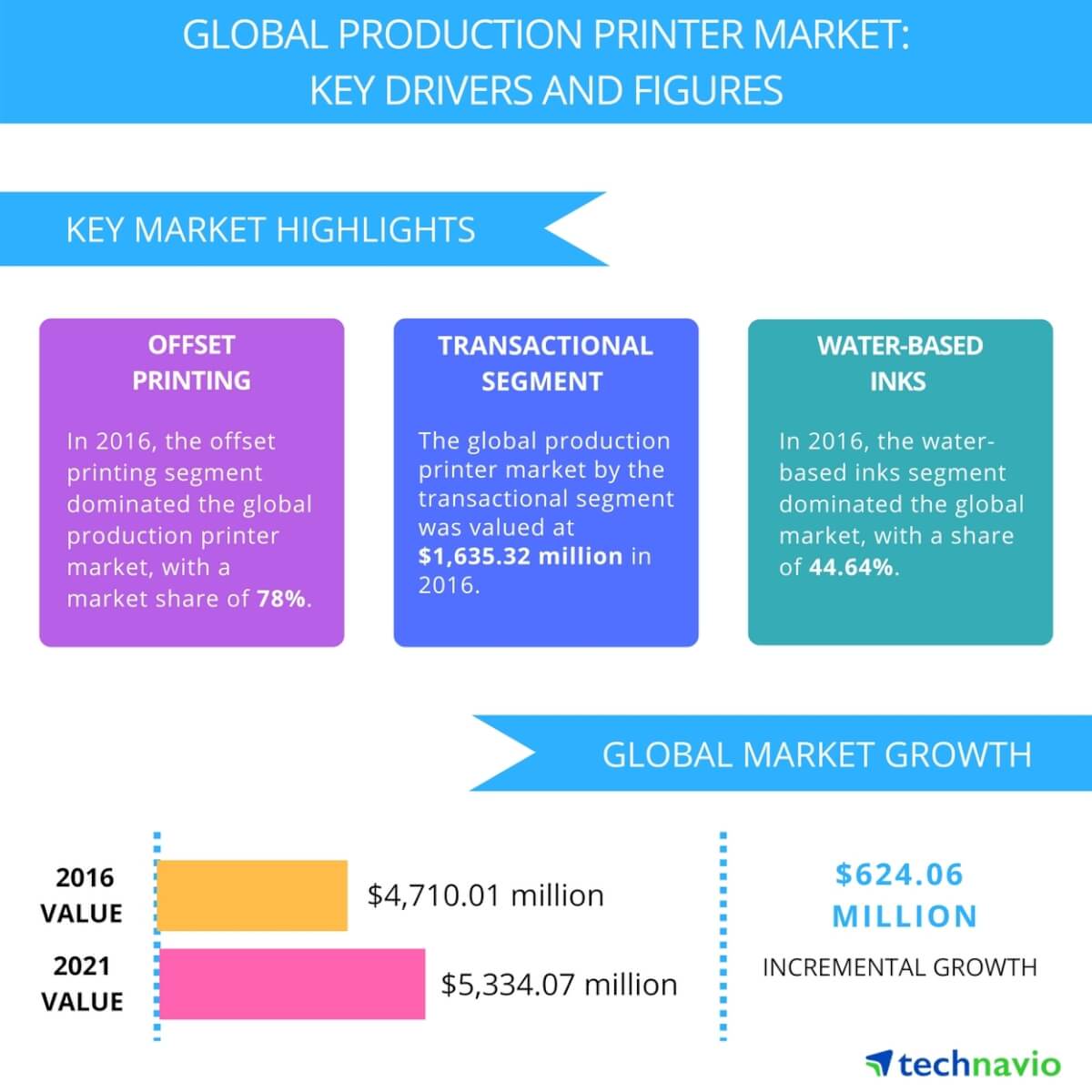

Technavio’s industry research report also presents a comprehensive analysis of the market by technology (offset printing and digital printing), by application (transactional, promotional, publishing, packaging, and others), by type of ink (water-based ink, solvent-based inks, UV-cured inks, and latex-based inks) and by geography (the Americas, APAC, and EMEA). For more information, visit Technavio here.

More Resources

- September 2016: IDC: Global Production-Printer Market Maintains Strong Growth, Shipments up 10.0 Percent in Second-Quarter 2016

- June 2016: ‘Solid Growth’ for Global Production-Printer Market, Reports IDC

- March 2016: IDC: Global Production-Printer Market up 5.2 Percent in Fourth-Quarter 2015

- December 2015: Global Production-Printer Shipments Near Double-Digit Growth in Third-Quarter 2015, Reports IDC

- August 2015: IDC: Worldwide Shipments for Production Printers up 9.4 Percent in Second Quarter

- May 2015: IDC: Positive Gains for Worldwide Production-Printer Market; Xerox is Leader

- March 2015: IDC: Canon is Market Leader in U.S. Cut-Sheet Production-Print Market

- July 2014: IDC: Global Digital Color Production-Print Market to Reach Nearly $25 Billion from 2014-2018

- June 2014: IDC: Global Production-Printing Market Achieves Double-Digit Growth in First-Quarter 2014

You must be logged in to post a comment.