Billionaire Investor Icahn Blasts Xerox Board, Says Xerox ‘Desperately Needs New Leadership’

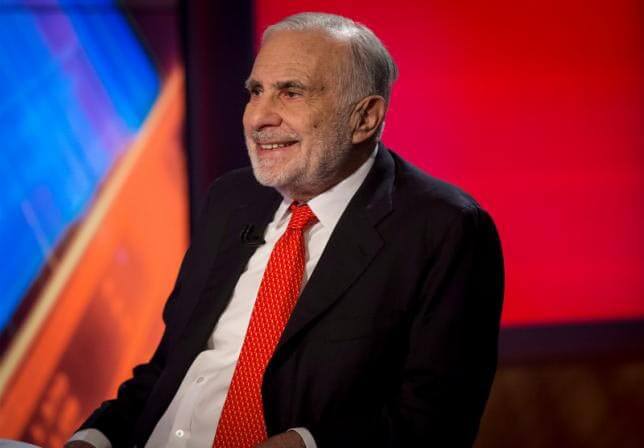

Carl Icahn

Just a day after he named four new directors to the Xerox Board of Directors, billionaire investor Carl Icahn is making waves – penning a withering letter this week to Xerox shareholders, stating, among other things, that “Xerox desperately needs new leadership.”

In his letter, Icahn compared Xerox to Eastman Kodak – the latter of which filed for Chapter 11 bankruptcy protection in 2012 – stating: “Yesterday, Xerox released a statement that paints a rosy picture of what is in reality a bleak situation that I fear could turn out like that of Eastman Kodak, where Xerox Chairman Bob Keegan worked for over 25 years and Xerox CEO Jeff Jacobson also served as a senior executive.”

Icahn contests Xerox’s allegedly “outrageous claim” that “shareholders have recognized Xerox’s progress, which is why the stock is up 30% year-to-date.”

Instead, Icahn claims that the “primary reason” that Xerox ‘s stock is up 30 percent year-to-date is Xerox’s Conduent spin-off that Icahn claims he spent over a year fighting for. He states that Xerox stock closed at $23.00 on December 30, 2016, and that, the following day, when markets were closed, Xerox completed the long-awaited spin-off of Conduent. As a result, he argues, the price of Xerox stock increased to close at $27.56 on the first trading day of 2017. Icahn says that the Xerox split he “championed” for is responsible for 75 percent of “the value creation Xerox claims as evidence of shareholder support.” Once that’s not taken into account, Icahn claims that ” Xerox stock dramatically underperformed the S&P 500 Index through Monday, December 11, 2017.”

In the letter to the Xerox board, Icahn subsequently claims that “Xerox desperately needs new leadership. Despite our efforts, the ‘old guard’ directors still remarkably defend a CEO that is incapable of (1) introducing new products that do more than play catch-up to competitors and (2) acknowledging that cost-cutting alone, particularly in sales, marketing, R&D and customer service, is not a formula for changing the current alarming revenue trajectory of ‘mid-single digit’ year-over-year percentage decreases.”

Icahn extorts Xerox shareholders “to speak up and demand that further new blood be introduced into the boardroom.” He claims that he and his associates “have shown time and time again that replacing an ineffective CEO can lead to billions and billions of dollars of value creation for ALL shareholders.” Among the examples he cites over the last few years are eBay, Forest Laboratories, Hologic, and Manitowoc, and asks for a change in senior leadership, again citing Eastman Kodak, stating that “long-tenured members of the board seem to have their heads in the sand just like at Eastman Kodak.”

Back in November 2015, Icahn disclosed a 7.13 percent stake in Xerox in a securities filing, which made him the second-largest shareholder of Xerox. At the time, Icahn said he would look at getting representation on Xerox’s board of directors, and would also consider “strategic alternatives” for the company, and said Xerox stock was “undervalued.” As of September, Icahn is Xerox’s largest shareholder with a 9.7 percent stake.

More Resources

- December 2017: Carl Icahn to Nominate Four Directors to Xerox Board

- June 2016: Carl Icahn Adds Christodoro to Xerox Board of Directors

- October 2016: Billionaire Investor Deason Files Lawsuit to Block Xerox Split into Two Companies

- October 2016: Xerox Rolls Out New Conduent Brand Logo as it Prepares for Split into Two Companies

- October 2016: Xerox’s BPO Group to Trade as Conduent on NY Stock Exchange Following Split

- November 2015: Billionaire Investor Icahn is Second-Largest Xerox Shareholder; Considering ‘Strategic Alternatives’ for Xerox

You must be logged in to post a comment.